WEST MARIN TRANSIENT OCCUPANCY TAX AREA

MEASURE W

MEASURE W: West Marin Transient Occupancy Tax. To address

tourism impacts on West Marin communities and paid

only by guests, shall the measure be adopted to increase

the transient occupancy tax in West Marin from 10%

to 14% for hotels/short-term rentals, and to apply 4%

tax to commercial campground visitors, to enhance fire/

emergency services and long-term community housing,

raising approximately $1.3 million annually, with local

oversight, annual audits, and all funds exclusively used

for West Marin, effective until amended/repealed?

YES NO

COUNTY COUNSEL’S IMPARTIAL ANALYSIS OF MEASURE W

WEST MARIN TRANSIENT OCCUPANCY TAX

The California Constitution and the Government Code

authorize the County, upon a 2/3 vote, to levy a special tax.

The Revenue and Taxation Code authorizes the County to

levy a tax on hotels, inns, tourist homes, motels or other

lodging for the privilege of guests occupying a room or

rooms in the unincorporated areas of the County. This tax

is called a Transient Occupancy Tax.

This new special tax will create a transient occupancy

tax rate of four (4%) percent of rent charged in the West

Marin Transient Tax Area for hotels, short-term rentals,

and bed and breakfasts, in addition to the 10% rate

applicable to the entire unincorporated County of Marin

for such lodgings. The tax will apply to visitors at hotels,

short-term rentals, bed and breakfasts, and other lodgings,

as defined in the measure, for the privilege of occupying

a room or rooms in the West Marin Transient Tax Area.

Additionally, the four percent (4%) tax shall apply to

campground visitors, except for campgrounds owned

by the Federal or State government. The purpose of the

special tax is to address visitor impacts by enhancing fire/

emergency services and long-term community housing.

The proceeds of the tax are estimated to be approximately

$1.3 million dollars annually, and all funds must be used

exclusively for the West Marin Transient Tax Area. After

administrative expenses, which are limited to 5% of the

annual revenue, one-half of the funds shall be allocated

for fire and emergency services and one-half of the funds

shall be allocated for community housing. An oversight

committee shall review expenditures to ensure compliance

with the measure’s requirements and shall review an annual audit.

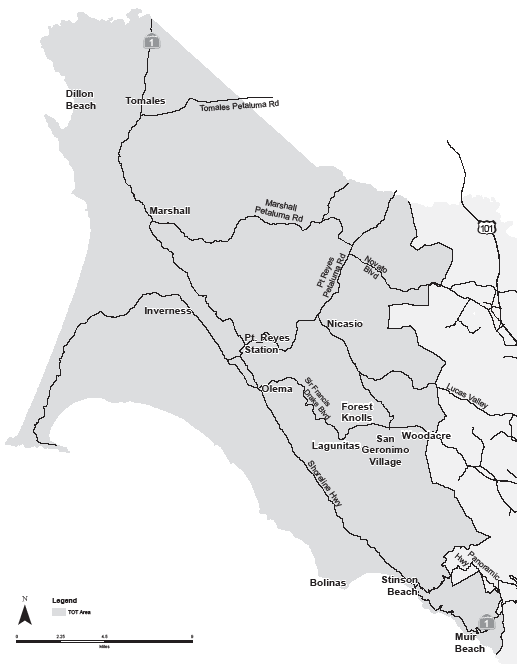

The measure defines the West Marin Transient

Occupancy Tax Area as the area of unincorporated west

Marin County included in the tax rate areas listed on Exhibit

B of the measure, as depicted on the map attached to the

measure as Exhibit A. This Special Tax will be effective

until amended or repealed and requires a 2/3 vote to pass.

If passed, the tax will become effective on January 1, 2019.

s/BRIAN WASHINGTON

Marin County Counsel

ARGUMENT IN FAVOR OF MEASURE W

A YES vote on Measure W means:

- Expected to generated $1.3 million annually to relieve visitor impacts in West Marin.

- This tax would only be paid by lodging guests at hotels and short-term rentals, not by permanent residents.

- New funding for community housing opportunities in West Marin.

- New funding for local support for our first responders.

- Local control of all budgets and expenditures.

Transient Occupancy Tax imposes no new taxes on West Marin residents. The new TOT funds will enhance the budgets of emergency responders and fund opportunities to address the critical shortage of community housing, partially caused by short term rentals.

West Marin’s increasing tourist and visitor congestion is severely straining the capabilities of West Marin emergency responders, especially our volunteer fire departments. Simultaneously, this influx of overnight visitors due to the increase in short term rentals has contributed to the shortage of community housing and reduced the availability of affordable housing.

A Yes vote addresses these twin crises by increasing the Transient Occupancy Tax, a hotel tax charged on visitors who stay less than 30 days. The TOT rate will be increased from 10% to 14% in West Marin. The additional 4% will generate $1,300,000 per year. Half of the new revenue will be used for the creation and support of community housing and half will be used for the expansion of our first responder capabilities, including recruiting, staffing and equipping our fire houses. None of this increase goes into the Marin County General Fund and can be only used for fire, ambulance, and emergency services and community housing in West Marin.

The distribution of these funds will be determined by two expenditure committees: a housing committee with representatives from all West Marin communities and a fire department committee with representatives from all West Marin fire departments. There will be an oversight committee to ensure that these funds are disbursed as mandated.

Please vote YES!

s/RALPH CAMICCIA

s/ALBERT ENGEL

s/WENDY FRIEFELD

s/SUZANNE SADOWSKY

Chair San Geronimo Valley Affordable Housing Association

s/MAUREEN CORNELLA

President Community Land Trust of West Marin

REBUTTAL TO ARGUMENT IN FAVOR OF MEASURE W

The County of Marin is negligent in regulating the non-residential absentee use of homes originally built for people to live in full-time and participate in the positive aspects of our community. Instead, Airbnb-like businesses, blessed by Supervisor Dennis Rodoni, continue to undermine the fabric of our community.

Rodoni’s leadership has led to the demise of Drakes Bay Oysters Company, trampling of San Geronimo Valley’s Community Plan, SPAWN’s attack on Lagunitas Creek Homeowners Property Rights, and the elimination of the San Geronimo Golf Course as a 50-year-old, profitable, tax-paying business costing 18MM and job loss. Now, Rodoni asks you to support another personal folly by protecting the Airbnbs decimating our schools, medical facilities, and lifestyle. Rodoni disregards local jobs and businesses to support approximately 500 new mini-hotels created in our residentially-zoned neighborhoods over the last few years, amounting to 1500 new bedrooms competing with just 350 traditional bedrooms. While traditional hotel occupancy declines, Rodoni’s short-sighted vision fails to fairly regulate the “visitorhoods” overtaking our neighborhoods and completely ignores the 97% day-visitors.

Your NO vote on Measure W sends a message to Rodoni, and other members of the Board of Supervisors, to limit non-hosted residentially-zoned short-term rentals lacking normal conditional use permits throughout Marin. Half of these Airbnb-like mini-hotels would disappear in future months. Thereby, West Marin would have 250 new homes re-opened for full-time residents, long-term community, and workforce housing rentals.

Voting NO on Measure W tells the Board of Supervisors to construct a lasting solution for our West Marin, and thus Greater Marin, community health.

s/JEFF HARRIMAN

Owner of Tomales Bay Resort and Marina

s/SUSAN NELSON

Owner of Lingonberry Farm Lodging

s/DORIS FERRANDO

Owner of Ferrando’s Hideaway Cottages

s/FRANK BORODIC

Owner of Roundstone Farm B&B

s/STEVE DOUGHTY

Owner of Point Reyes Vineyard Inn

ARGUMENT AGAINST MEASURE W

Neighbors, we urge you to vote NO on Measure W. Passage will only quicken and ensure the hollowing out of our West Marin Villages while delaying the inevitable hard work our elected officials must do to address the true issues responsible for the lack of affordable housing and infrastructure necessary to meet West Marin’s community and visitor needs. Of the exponentially increasing 900 Short Term Rentals (STRs) currently in West Marin, 400 do not pay any transient occupancy tax (TOT) according to the Marin County Tax Collector. These “invisible” STRs, whose presence has at least doubled over the past three years, must be identified and taxed the appropriate amount to pay their fair share back into the community. Mostly owned by non-residents, STRs should be required to have conditional use permits appropriate for their location. Measure W is the easy way out for elected officials but does not provide adequate funding to truly accomplish its goals. Should it successfully raise $1.3M, the funds will be split between six volunteer and six county fire departments and at least four affordable housing groups. The County of Marin will pay itself $68,000 annually to administer these funds. Measure W fails to provide a plan for division of funds as well as an alternative solution should the TOT collected decrease as a result of higher costs to the 3% of visitors staying in the establishments to be taxed. Passage will burden local businesses, create job losses, and reduce existing resources shared by local residents. Your “NO” vote sends elected officials the message that a sustainable, fair solution to our affordable housing crisis is needed. Ballot Measure W, crafted secretly with only politicians and special interest groups present, appears to be and is too good to be true. Vote NO on Measure W to demonstrate your focus on a thriving, long-term community.

s/FRANK BORODIC

Owner of Roundstone Farm B&B

s/SUSAN NELSON

Owner of Lingonberry Farm Lodging

s/DORIS FERRANDO

Owner of Ferrando’s Hideaway Cottages

s/JEFF HARRIMAN

Owner of Tomales Bay Resort and Marina

s/STEVE DOUGHTY

Owner of Point Reyes Vineyard Inn

REBUTTAL TO ARGUMENT AGAINST MEASURE W

Neighbors, the argument against Measure W is full of inaccuracies. Measure W does not “quicken and ensure the hollowing out of our communities” -- it actually provides a solution to that trend by creating funding for both community housing and our stressed volunteer fire departments in their efforts to protect the wellbeing of visitors and residents alike. It does not “delay” other efforts to provide affordable housing -- it encourages such efforts and provides the critical seed money needed to start them. Contrary to the Argument Against W, the measure provides for two expenditure committees, both staffed by West Marin locals, to ensure that the funds are used only in West Marin and only for housing and emergency responder support. Contrary to the Argument Against W, local businesses are not burdened. If they are short-term rental operators, they must collect an additional 4% in hotel tax from their guests; only overnight visitors are affected, not West Marin residents nor other businesses. Resources will not be reduced for locals, but rather increased, as new and critical funding will be provided for both housing and emergency services. W is not “too good to be true” -- it is a sensible measure to collect from visitors to West Marin the funds to counter some of the impacts that those visitors have on our communities. Yes on W means Support for Community Housing, Support for Fire and Ambulance services, No Tax Increase on Residents, Local Control of Funds.

s/CHRISTOPHER HARRINGTON

s/DENNIS RODONI

s/MARCUS WHITE

FULL TEXT OF MEASURE W

ORDINANCE NO. 3692

ORDINANCE OF THE MARIN COUNTY BOARD OF SUPERVISORS ESTABLISHING THE WEST MARIN TRANSIENT OCCUPANCY TAX AREA BY AMENDING CHAPTER 3.05 UNIFORM TRANSIENT OCCUPANCY TAX OF THE MARIN COUNTY CODE

THE BOARD OF SUPERVISORS OF THE COUNTY OF MARIN ORDAINS AS FOLLOWS:

Section 1. Findings:

The Board makes the following findings in support of this ordinance:

- The number of visitors to West Marin generates the need for additional fire and rescue services to accommodate the visitors, while meeting the needs of the resident community.

- Conversion of single family dwellings to short term rentals to serve visitors has reduced the availability of long term housing in West Marin.

- As a result of West Marin’s predominantly rural character, these issues affect West Marin in a different manner from the rest of the unincorporated county. Presently, approximately 75% of the Transient Occupancy Tax that the County of Marin collects arises from lodgings in West Marin. As a result, more visitor impacts arise in West Marin than in the remainder of unincorporated Marin County. For fire and rescue services, the greater distances in West Marin that fire and rescue services must travel, and the higher ratio of visitors to existing residents, results in visitors having a larger impact on emergency services in West Marin than in other unincorporated areas. In addition, the smaller housing stock in West Marin – compared to other unincorporated areas -- magnifies the impact of short-term rentals on the availability of housing in West Marin.

- Good governance and equity requires that visitors that are benefitting from local government services and housing help pay the burden of the services provided to them, rather than allowing the burden to fall mainly on the resident tax payers.

Section 2. Nature of Tax:

If approved by a two-thirds majority of the electorate voting on the measure, the ordinance will create a transient occupancy tax rate of four (4) percent (“the West Marin Transient Occupancy Tax”) of rent charged in the West Marin Transient Occupancy Tax Area, in addition to the tax rate of ten (10) percent applicable to the entire unincorporated County of Marin. A West Marin Transient Occupancy Tax Area rate of 14 percent aligns with the 14 percent rate of neighboring San Francisco. The West Marin Transient Occupancy Tax is a tax imposed upon transients for the privilege of occupying hotels, short-term rentals, bed and breakfasts, and campgrounds located within the West Marin Transient Occupancy Tax Area. The West Marin Transient Occupancy Tax is a special tax that shall be used for the benefit of the West Marin Transient Occupancy Tax Area.

Half of the West Marin Transient Occupancy Tax collected shall be allocated for fire and emergency services in the West Marin Transient Occupancy Tax Area. Included in this allocation are the fire districts and volunteer fire departments located in West Marin, currently the Bolinas and Stinson Beach Fire Protection Districts, the Fire Department in the Inverness Public Utility District, and Nicasio, Muir Beach, and Tomales volunteer fire departments. The allocation also shall include the Marin County Fire Department stations in Tomales, Point Reyes Station, Hicks Valley, Woodacre and Throckmorton (on Mount Tamalpais). The allocation shall be subject to approval by the Marin County Board of Supervisors. The funds will be administered by the Marin County Fire Department. In the allocation for fire and emergency services, the Marin County Fire Department shall not obtain more funds in a year than the combined allocation to the other West Marin fire districts and volunteer fire departments. The County Fire Chief is expected to establish an ad-hoc working group to help inform his or her recommendation to the Board of Supervisors.

Half of the West Marin Transient Occupancy Tax collected shall be allocated for community housing in the West Marin Transient Occupancy Tax Area, including, but not limited to, housing for West Marin public safety employees, teachers and other members of the West Marin workforce, housing for families, housing for persons with disabilities and housing for seniors. The allocation shall be subject to approval by the Marin County Board of Supervisors. The funds will be administered by the Marin County Community Development Agency (CDA). The CDA Director is expected to establish an ad-hoc working group to help inform his or her recommendation to the Board of Supervisors.

West Marin Transient Occupancy Tax proceeds are intended to augment support for West Marin fire and emergency protection, as well as West Marin community housing. Therefore, disbursement of West Marin Transient Occupancy Tax proceeds shall be subject to terms and conditions established by the County including, but not limited to, requiring recipients to certify that these funds are being used to enhance services beyond their available resources.

The West Marin Transient Tax Area increase will be collected by the operators, in the same manner as the current transient occupancy tax is collected. The collection of the tax from operators shall be administered by the Marin County Tax Collector as provided by the Board of Supervisors for the County of Marin. The West Marin Transient Occupancy Tax is currently estimated to raise approximately $1.3 million annually.

In addition to the accountability measures required by law, the County of Marin will establish an Oversight Committee comprised of residents who live in the West Marin Tax Area. The Oversight Committee shall be provided with an annual audit of the revenue and expenditures of the West Marin Transient Occupancy Tax. The Oversight Committee shall provide oversight as to the expenditure of transient occupancy tax revenue to ensure that the revenue is spent within the boundaries of the West Marin Tax Area and for the purposes approved by the voters. Should the measure pass, the direct costs of the election will be reimbursed from the initial tax collection revenue from the West Marin Transient Occupancy Tax Area on a one-time basis. Administrative expenses of the County of Marin shall not exceed 5% of the tax revenue in any year, with any costs of the annual audit for the Oversight Committee paid first, and the remainder split equally between fire/emergency services and community housing.

The Marin County Board of Supervisors shall approve bylaws for the Oversight Committee. Meetings of the Oversight Committee shall be open to the public and shall be held in compliance with the Ralph M. Brown Act, California’s open meeting law.

Section 3. Addition to Marin County Code, Section 3.05.035:

The Marin County Code is amended to add Section 3.05.35, as follows:

(a) Notwithstanding the tax imposed by Section 3.05.030 and in addition thereto, commencing on January 1, 2019, for the privilege of occupancy in any hotel or campground in the West Marin Transient Occupancy Tax Area, each transient is subject to and shall pay an additional tax in the amount of four percent of the rent charged by the operator. The tax constitutes a debt owed by the transient to the county, which is extinguished only by payment to the operator or to the county. The transient shall pay the tax to the operator of the hotel or campground at the time the rent is paid. If the rent is paid in installments, a proportionate share of the tax shall be paid with each installment. The unpaid tax shall be due upon the transient’s ceasing to occupy space in the hotel or campground.

(b) “West Marin Transient Occupancy Tax Area” means the area of unincorporated Marin County from Muir Beach to Dillon Beach and includes Nicasio, eastward to the top of Big Rock ranch, including San Geronimo Valley to the top of White’s Hill, but excludes other unincorporated areas of Marin County, as depicted by the West Marin Transient Occupancy Map attached to this ordinance as Exhibit A, as defined in the list of tax rate areas attached to this ordinance as Exhibit B.

(c) “Campground” means any park or real property where a person may locate a tent, trailer, tent trailer, pick-up, camper, or other similar temporary structure for the purposes of lodging, dwelling, or sleeping, whether or not water, electricity, or sanitary facilities are provided. A campground shall not include any park or real property owned by the State of California or the federal government of the United States of America.

(d) For the purposes of Section 3.05.035 only, “Transient” means any person using a campground or exercising occupancy or who is entitled to occupancy of a campground, in addition to the definition of “Transient” as set forth in Section 3.05.020(d).

(e) For the purposes of Section 3.05.035 only, “Operator” means the person who is proprietor of the campground, whether in the capacity of owner, lessee, sublessee, mortgagee in possession, licensee, or any other capacity, in addition to the definition of “Operator” as set forth in Section 3.05.020(f). The managing agent of a campground shall be treated in the same manner as a managing agent set forth in Section 3.05.020(f).

Section 4. Ballot Language:

The Board of Supervisors orders that the following question be placed as a County Measure within the West Marin Transient Occupancy Tax Area on the ballot of the general election to be held November 6, 2018.

West Marin Transient Occupancy Tax

To address tourism impacts on West Marin communities and paid only by guests, shall the measure be adopted to increase the transient occupancy tax in West Marin from 10% to 14% for hotels/short-term rentals, and to apply 4% tax to commercial campground visitors, to enhance fire/emergency services and long-term community housing, raising approximately $1.3 million annually, with local oversight, annual audits, and all funds exclusively used for West Marin, effective until amended/repealed?

Section 5. Severability:

If any provision of this ordinance or the application thereof to any person or circumstance is held invalid, the remainder of the ordinance and the application of such provision to other persons or circumstances shall not be affected thereby.

Section 6. Election:

An election shall be held on November 6, 2018, on the issue of increasing the transient occupancy tax rate by four percent in the West Marin Transient Occupancy Tax Area, and making private campgrounds subject to a new four percent tax. Notwithstanding Elections Code Section 9125, without a vote of the People, the County of Marin Board of Supervisors may further amend this Ordinance in a manner that does not impose, extend, or increase the rate of the West Marin Transient Occupancy Tax.

Section 7. Effective and Operative Dates:

This ordinance shall take effect immediately upon its adoption by a two-thirds majority of the electorate voting on the ordinance at the November 6, 2018, general election. The operative date of Section 3 shall be January 1, 2019.

Section 8. Appropriations Limit:

If necessary, pursuant to Article XIIIB of the California Constitution, the appropriations limit for the County of Marin is increased to the maximum extent over the maximum period of time allowed under the law consistent with the revenues generated by the tax provisions of this Ordinance.

Section 8. Compliance with the California Environmental Quality Act (CEQA):

Pursuant to CEQA Guidelines Section 15378(b)(4), adoption of this ordinance as a government funding mechanism is not a project subject to the requirements of CEQA.

Section 9. Vote:

This ordinance No. 3692, shall take effect and be in force pursuant to Section 7, above, if approved by the voters as provided in that Section. Before the expiration of 15 days after passage by the Board of Supervisors, the ordinance shall be published once with the names of members voting for or against, in the Marin Independent Journal, a newspaper of general circulation published in the County of Marin.

PASSED AND ADOPTED at a regular meeting of the Board of Supervisors of the County of Marin held on this 31st day of July 2018, by the following vote:

AYES: SUPERVISORS Dennis Rodoni, Katie Rice, Judy Arnold, Kathrin Sears, Damon Connolly

NOES: NONE

ABSENT: NONE

s/DAMON CONNOLLY

President Board of Supervisors

ATTEST:

s/MATTHEW HYMEL

Clerk of the Board

EXHIBIT A

WEST MARIN TRANSIENT OCCUPANCY TAX

EXHIBIT B

This Exhibit B lists the Tax Rate Areas (“TRAs”) that are

included in the West Marin Transient Occupancy Tax Area,

as depicted on the West Marin Transient Occupancy Map

(Exhibit A). Inquiries on whether parcels are included

within the West Marin Transient Occupancy Tax Area

should be directed to the Marin County Department of

Finance at (415) 473-6168.

| TRA |

ParcelCnt |

| 056001 |

21 |

| 056003 |

226 |

| 056004 |

1 |

| 056005 |

95 |

| 056006 |

3 |

| 056007 |

841 |

| 056008 |

3 |

| 056009 |

1 |

| 056013 |

3 |

| 056014 |

70 |

| 056016 |

4 |

| 056017 |

3 |

| 056018 |

2 |

| 056021 |

1 |

| 056022 |

909 |

| 056024 |

2 |

| 056027 |

3 |

| 056028 |

14 |

| 060002 |

2 |

| 060025 |

3 |

| 068001 |

3 |

| 068013 |

2 |

| 068018 |

1 |

| 068019 |

1 |

| 069002 |

111 |

| 070002 |

1883 |

| 070003 |

11 |

| 070004 |

1 |

| 070005 |

20 |

| 072001 |

43 |

| 072002 |

2 |

| 072003 |

3 |

| 072004 |

26 |

| 075001 |

19 |

| 075007 |

20 |

| 075030 |

1 |

| 075036 |

1 |

| 075048 |

185 |

| 076003 |

365 |

| 094001 |

646 |

| 094002 |

191 |

| 094008 |

144 |

| 094010 |

716 |

| 094018 |

31 |

| 094019 |

396 |

| 094020 |

310 |

| 094021 |

84 |

| 094022 |

192 |

| 094023 |

13 |

| 094024 |

62 |

| 094035 |

465 |

| 094056 |

123 |

| 095000 |

40 |